Paying Your Mortgage

Options for Paying Your Mortgage

Purchase Plus Improvements

Including Renos or Upgrades With Your Purchase

No Frills Mortgages

Beware of No-Frills Mortgages

Mortgage Lenders

The Different Types of Mortgage Lenders

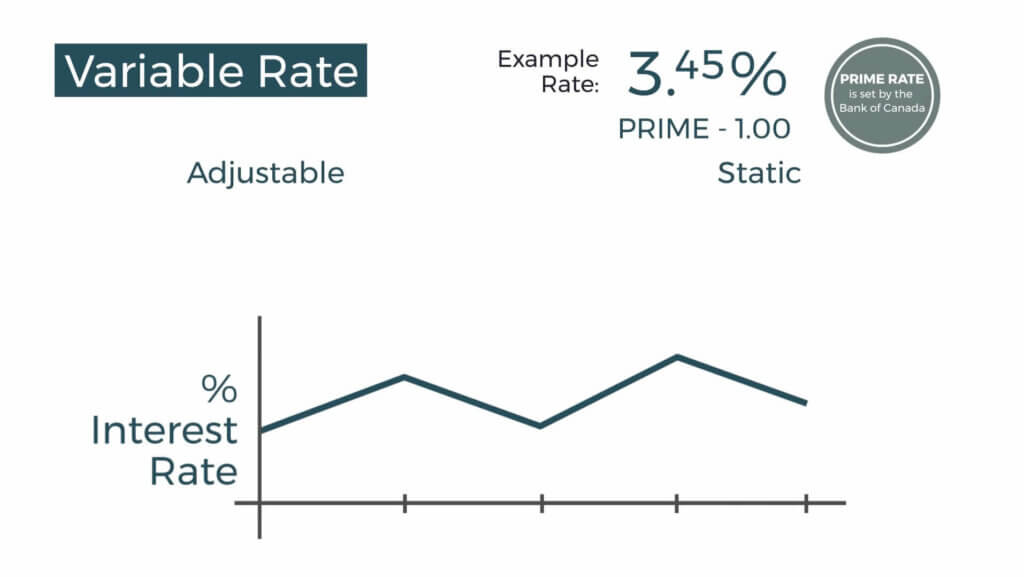

Fixed vs. Variable Rates

Fixed vs. Variable Rates

Closing Costs

Preparing for Closing Costs

Common Mistakes

5 Do’s & Dont’s to Protect Your Pre-Approval

10 Great Reasons To Buy Life Insurance

If you are looking to obtain Life Insurance or would like a second opinion about existing insurance coverage, an insurance advisor on our team can help. We can review your information and policy and give you an analysis of what exactly it is that you should have and determine whether the policy you have is the correct one for you and your family. We can also assist your loved ones in the event of a claim. In these situations, we understand that it is a difficult time for everyone involved and we will handle things in a sensitive manner.

10 Great Reasons To Get Critical Illness Insurance

We live in a world that is filled with the uncertainty of what might happen. Life Insurance protects your loved ones in the event of your death. It can provide future income to your family if you were to pass away during your prime working years, and it may also be used to pay debt, such as a mortgage, final and emergency expenses.

Location, Location, Location

There is an old Canadian joke that says the three most important things in choosing a home are: location, location, location!